Source: https://www.dealstreetasia.com/stories/chinas-ai-drug-discovery-315723?giftKey=FWYd1XTkTKbp

Is China's AI-driven drug discovery sector ready to take on global centrestage?

Though a late-comer, China has emerged at the centre of global development in AI-driven drug discovery.

Favorable government policies, the proliferation of biotech infrastructure, and capital influx from internet giants including the likes of Tencent, Baidu, and ByteDance, have underpinned the growth of AI drug discovery – seen as a red-hot market – in China over recent years.

To tap into the market potential, China’s leading upstarts have garnered funding from top global investors as well as marked significant breakthroughs.

But, a slew of roadblocks including near-term capital challenges, growing competition, the long road to profitability, the availability of talent, and the escalating China-US political tension may temper the ambition.

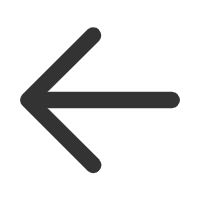

Source: McKinsey & Company’s report titled Vision 2028: How China could impact the global biopharma industry

Overvalued assets

Although China’s healthcare and biotech industries have experienced an investment tailwind over the past few years, they have entered a new phase in which the majority of the ventures have been “overvalued” and “over-invested”, according to investors and industry players.

The country’s biotech sector clocked a total of 165 deals that raised a combined $4.6 billion from Q1 to Q3 2022. The deal value was down by 36.7% from the same period in 2021 when it raised a total of $7.2 billion, according to proprietary data compiled by DealStreetAsia.

“The healthcare sector has become heated in a short period of time, in which businesses have received a lot of capital and it pushes up the valuation,” Henry Zhang, president and managing partner of Hong Kong-headquartered Hermitage Capital, a private-equity firm with $1.5 billion in assets under management, told Dealstreetasia.

He added that macro factors such as interest rate hikes, and geopolitical tension, also contribute to the investment downturn.

“Eventually, people want to see the results right away, but pharma R&D is a time-and-capital consuming process. Therefore, you see a lot of pre-revenue biotech companies have been listed in Hong Kong. However, from a secondary market investor perspective, they [the investors] are losing patience and want to see the actual financial results,” Zhang commented.

Effective April 30, 2018, Hong Kong Exchanges and Clearing (HKEX)’s Chapter 18A enables pre-revenue and pre-profit biotech firms to tap the city’s bourse. A “B” marker is included next to the stock name of the listed biotech firms, which will be erased once the firms generate a certain level of profits and revenues.

However, only four out of 48 biotech firms managed to apply to have the “B” mark removed, which took around 10 to 20 months after those firms’ IPO, as of 2021, according to a report published by corporate law firm Skadden, Arps, Slate, Meagher & Flom LLP in June.

“It makes the fundraising environment more challenging for new pharmaceutical companies. This has impacted AI drug discovery firms indirectly, as those firms help pharmaceutical firms to discover drugs, but the tech itself has already been proven,” said Zhang.

Despite the market conditions, Zhang remains bullish about the prospects. “Within the next two to three years, we’ll see more AI drug discovery firms going public. We expect to see a rebound in the capital market within the next 12 months,” he said.

“A winner-takes-all market”

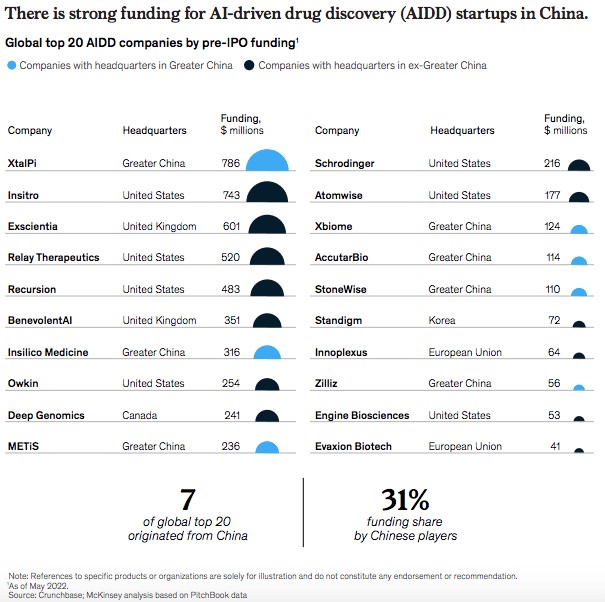

In 2022, China’s AI drug discovery sector logged only $600 million in investment, accounting for 9% of the global financing in the sector while the US logged $4.8 billion, or 77% of the total deals, according to the Intellectual Medicine Bureau, a Chinese publication that provides news related to the AI drug discovery sector. The deal value was down by half compared to the 2021 figure of $1.2 billion.

The sluggish fundraising environment signifies a major shift within the sector — for some, the next two to three years could be “a fight to survival”, according to a report titled ‘Vision 2028: How China could impact the global biopharma industry’ by McKinsey & Company.

“Recent market volatility underscores the need for biotechs to be more disciplined about allocating capital,” the report said. “Companies facing cash constraints may need to reprioritize their portfolios, enter partnerships to share development and commercialization costs, or delay major investments. By conserving cash, companies can continue to develop the assets already in their pipelines without giving up their ability to place strategic long-term bets,” it added.

Ultimately, not all firms can survive on the battlefield. “The industry is now consolidating, and we are scaling up. I believe this is going to be a winner-takes-all market,” Alex Zhavoronkov, founder and CEO of Hong Kong-based Insilico Medicine, a clinical-stage AI drug discovery startup, told Dealstreetasia.

Path to profitability

Major AI drug discovery firms continue to scale up by inking partnership deals with big pharma amid tightening competition. Xtalpi, the world’s most-funded AI pharmatech upstart as of Q3 2022, is one such example.

“When we first invested in Xtalpi, it was a niche AI research service provider for pharmaceutical companies,” said Zhang, whose PE firm also invested in Xtalpi.

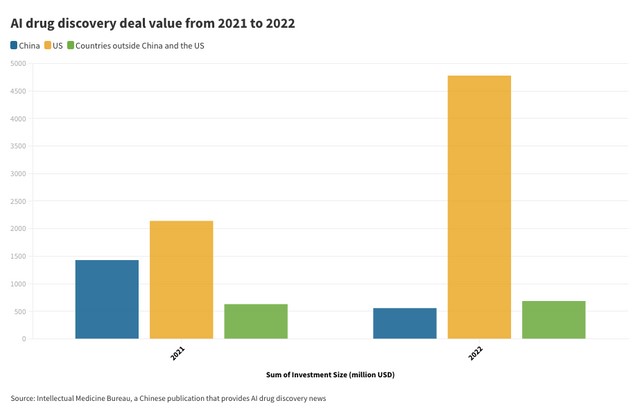

Founded in 2014 by a group of quantum physicists from MIT, XtalPi specialises in AI-powered drug research and development, with operations in both China and the US. It has amassed a total of $791 million from top-notch investors. It has over 1,000 employees and four campuses worldwide.

“The firm has since developed robotic wet lab capabilities and became a full-stack AI CRO with a technology platform that connects machine learning with experimental validation,” Zhang said. Currently, Xtalpi is working with 15 out of the top 20 global pharmaceutical firms, as well as inking “long-term engagements” with both Pfizer and Johnson & Johnson.

Last December, XtalPi also announced to partner with the Experimental Drug Development Centre (EDDC), Singapore’s national platform for drug discovery and development, to discover novel treatments for non-small cell lung cancer.

Hong Kong-based Insilico Medicine counts its drug discovery pipeline as its major revenue. “We have 31 therapeutic programmes right now, probably the largest number in the industry,” said Zhavoronkov, adding that the firm also monetises through selling its AI software. So far, “9 out of the top 30 pharma firms” are using the firm’s software, per Zhavoronkov.

Top 10 AI in Pharma Companies by Total Investments in Q4 2022

Source: Deep Pharma Intelligence’s Q4 report on the landscape of AI drug discovery.

Launched in 2014 at Johns Hopkins University in Baltimore, Zhavoronkov moved the headquarters to Hong Kong in April 2019. The firm’s potential first-in-class drug to treat idiopathic pulmonary fibrosis (IPF), has reached positive topline results after its first phase of clinical trial, per a company announcement on January 10.

Nutshell Therapeutics, a Chinese developer of allosteric drugs, too, aims to become more than an AI discovery firm. “In the long-term, we want to be a full-fledged pharma company,” Kevin Xie, executive vice president of business development at Nutshell Therapeutics, told Dealstreetasia.

He added that the firm’s business model consists of developing its own pipeline as well as licensing partnership in which the firm sells its AI platform for allosteric drug discovery to pharma firms. “So far, we already have two ongoing partnerships,” he said.

Despite the traction that those firms have been making, Xie explained that reaching profitability remains an issue among AI drug discovery firms, in general, thanks to the complexity of the process.

Roadblocks ahead

The sector faces growing competition and government policy changes that can impact the profitability of drugs, according to Xie.

“The success rate is low as most of the compounds eventually fail while getting the drugs approved and getting them launched to the market are additional challenges. So there is no guarantee for revenue or positive return on investment,” he added.

Talent is another area of concern. “There is a lot of competition for talent equipped in both AI and biology or chemistry. They are scarce and even if a firm recruits them, they tend to leave after a year or so for better offers. In the drug discovery industry, you need to work in the same company for at least three to four years before you see progress. The talent fluidity is much higher in China,” said Zhavoronkov.

Only through collaboration can the world achieve true pharmaceutical innovation. As the industry continues to grow, he predicts that massive investments will be driven into robotics targeting discovery, as the sector is more mature.

Back

Back